US-China Trade War Key Events Timeline

February to April 2025

Share this analysis

Help others stay informed about the US-China trade war

Live Updates

Tracking 22 eventsThis page is actively monitoring US-China trade relations. Events are updated as they occur.

Duration of US Trade Negotiations

Current progress compared to Average:

0 months since negotiations began on 4/2/2025

April 2, 2025 — "Liberation Day": Start of Current Negotiations

On this day, President Trump announced a minimum 10% tariff on all US imports (effective April 5) and higher tariffs on imports from 57 countries. The announcement of these controversially named "reciprocal tariffs" prompted immediate retaliation from trade partners and triggered a significant stock market crash. This date marks the beginning of the current US-China trade negotiations being tracked above.

Previous US-China Trade Negotiations

Phase One Deal (Trump 1.0)

Obama-Xi Dialogues

This table summarizes key events and statements related to the US-China trade war, focusing on the period from February 1, 2025, to the start of major tariff actions in April 2025. It expands the original table to include additional significant developments, capturing the escalation of tariffs and diplomatic rhetoric during this critical phase of the trade conflict.

The February 2025 reignition of the US-China trade war follows a complex history of economic tensions between the world's two largest economies:

- First Trump Administration (2018-2021): Initial tariffs on solar panels, steel, and aluminum in early 2018 escalated to duties on hundreds of billions in goods. The January 2020 "Phase One" deal required China to purchase $200 billion in additional US goods.

- Biden Administration (2021-2025): Maintained most Trump-era tariffs while pursuing a more multilateral approach, focusing on supply chain security and technology competition rather than trade balance concerns.

- Trump's Return (January 2025): The second Trump administration immediately signaled a hard-line approach to China, culminating in the February 1, 2025, announcement of new tariffs, triggering the current escalation cycle.

The 2025 trade conflict is distinct from earlier tensions due to its unprecedented tariff rates, broader global economic implications, and the context of increasing geopolitical tensions over Taiwan, technology access, and regional security.

The chart below illustrates the rapid escalation of tariffs between the US and China from January to April 2025, showing the dramatic increase in average tariff rates on imported goods.

Source: RiskWhale analysis based on official tariff announcements. Rates shown are weighted averages across affected product categories.

US Strategic Advantages

Trade Imbalance Leverage

China's dependency on US markets (5:1 export ratio) creates asymmetric vulnerability to tariffs

Reserve Currency Status

Dollar dominance in global markets provides stability during trade turbulence

Agricultural Self-Sufficiency

Less dependent on food imports than China, reducing vulnerability to retaliatory tariffs

Alliance Network

Extensive trade relationships with EU, Japan, and other developed economies provide alternatives

Technology Leadership

Maintains edge in semiconductor design, software, and advanced computing platforms

Consumer Market Leverage

Access to US consumers remains critical for Chinese manufacturers and exporters

China Strategic Advantages

Manufacturing Dominance

Controls critical supply chains for electronics, pharmaceuticals, and consumer goods

Political System

Centralized governance allows absorption of economic pain without electoral consequences

Rare Earth Elements

Controls ~80% of global processing capacity for these critical materials

State Control

Ability to direct industries, subsidize affected sectors, and manage public messaging

Belt and Road Initiative

Extensive trade relationships with developing nations provide alternative markets

Debt Leverage

Holds over $1 trillion in US Treasury bonds, creating financial interdependence

Analyst Assessment

The current trade war features mutual vulnerability despite asymmetrical trade flows. While the US holds significant leverage through China's export dependency, China's control of manufacturing supply chains and capacity to absorb economic pressure through state intervention creates resilience. The conflict tests whether economic interdependence or political will proves more decisive in trade negotiations.

Key Figures in the Trade War

The individuals shaping strategies and making decisions on both sides of the US-China trade dispute.

Donald Trump

Donald Trump's negotiation approach, famously outlined in his book 'The Art of the Deal,' provides insight into his handling of the 2025 US-China trade conflict. His aggressive escalation of tariffs and public confidence about securing a deal within weeks reflect core principles from his business playbook.

Trump's negotiation style emphasizes bold moves, psychological tactics, and leveraging power imbalances. In the trade war context, his approach is characterized by extreme opening positions (145% tariffs), creating urgency through deadlines, and a willingness to walk away from negotiations.

Key Negotiation Principles

- Think Big: Set ambitious goals to push harder and achieve more

- Use Leverage Aggressively: Identify and exploit strengths to pressure the other party

- Be Willing to Walk Away: Signal confidence by showing you're not desperate

- Create a Sense of Urgency: Use time pressure to force quick decisions

Practical Tactics

- Start with an Extreme Offer: Anchor negotiations in your favor

- Control the Narrative: Frame the deal to your advantage

- Publicity as a Weapon: Use media to pressure opponents

- Fight for Every Inch: Negotiate hard on every point

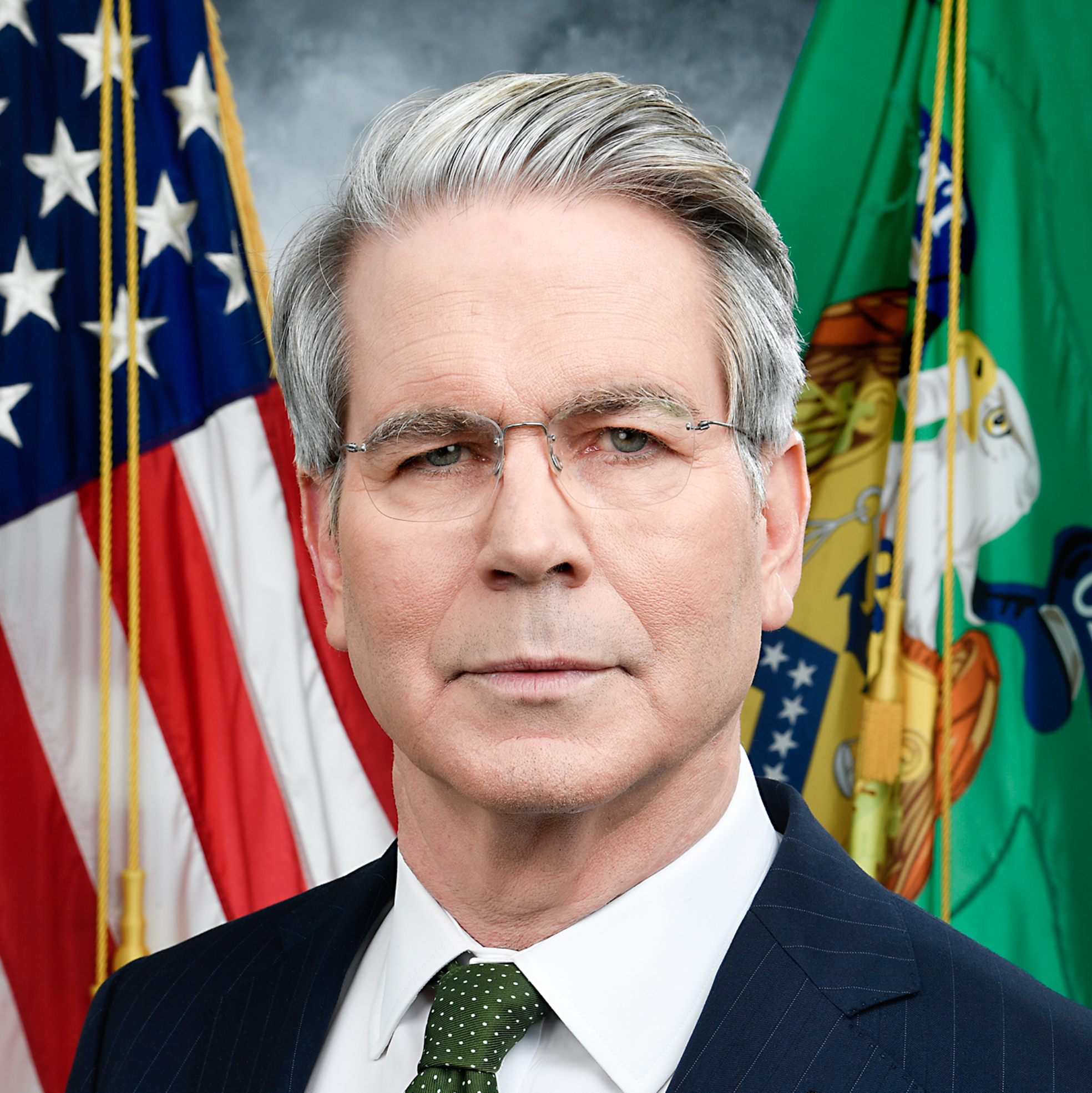

Scott Bessent

Scott Bessent serves as Treasury Secretary in the second Trump administration, bringing decades of experience as a global macro investor and hedge fund manager to the role. As founder of Key Square Group and former CIO of Soros Fund Management, Bessent has extensive experience analyzing global economic trends and currency markets.

In the context of the 2025 trade war, Bessent has emerged as a moderating voice in contrast to the president's aggressive tariff policies. His April 22nd statement that the trade war is 'unsustainable' signaled to markets that financial pragmatism exists within the administration, even as tariffs reached unprecedented levels.

Bessent's background combines Wall Street savvy with previous government experience, having served as an advisor to Hungarian monetary authorities in the 1990s. His network includes relationships with international financial leaders that may prove valuable in eventual trade negotiations.

Economic Perspective

- Pragmatic: Views tariffs primarily as negotiating leverage rather than permanent policy

- Market-Oriented: Concerned about financial stability and investor confidence

- Strategic: Focuses on China's trade surplus as key negotiating point

- Forward-Looking: Working on alternative trade deals (like with India) to pressure China

Background

- Founder of Key Square Group (global macro investment firm)

- Former Chief Investment Officer at Soros Fund Management

- Yale University graduate

- Experience in currency markets and global financial systems

Xi Jinping

Xi Jinping, China's most powerful leader since Mao Zedong, has positioned himself as a strong defender of Chinese interests during the 2025 trade war. Under his leadership, China has demonstrated unwavering resolve in the face of U.S. tariff escalations, retaliating with matching measures.

Xi's approach to the trade conflict is shaped by his broader vision of the 'Chinese Dream' and national rejuvenation. His statement that 'China will never be afraid' and is 'ready to fight to the end' encapsulates his blend of nationalist rhetoric and strategic patience in international confrontations.

Since assuming leadership in 2012, Xi has consolidated power and eliminated term limits, allowing him to maintain consistent long-term policies. This political stability gives China strategic advantages in a prolonged trade war, as Xi can sustain economic pressure without the electoral concerns facing democratic leaders.

Leadership Philosophy

- National Rejuvenation: Restoring China's historical greatness

- Self-Reliance: Reducing dependency on foreign technologies

- Party Control: Maintaining CCP authority over economic decisions

- Strategic Patience: Willingness to endure short-term pain for long-term gain

Trade War Strategy

- Targeted Retaliation: Focusing on politically sensitive U.S. exports

- Domestic Resilience: Building supply chain alternatives

- International Alliances: Strengthening ties with EU and other trading partners

- Multilateral Framework: Leveraging WTO and international institutions

Li Chenggang

Li Chenggang is China's newly appointed international trade representative and vice minister of commerce, announced on April 16, 2025, replacing Wang Shouwen. At 58, Li brings extensive experience, having served as China's ambassador to the World Trade Organization (WTO) since 2021 and as an assistant commerce minister during Trump's first administration.

He holds a law degree from Peking University and a master's in law and economics from the University of Hamburg. His appointment comes amid escalating U.S.-China trade tensions, with U.S. tariffs on Chinese imports reaching 145% and China retaliating with 125% tariffs on U.S. goods.

Li's WTO background suggests a strategic shift toward leveraging international frameworks to navigate the trade war. Analysts see his role as critical in potential negotiations to de-escalate tariffs, though no formal talks have started.

Education

- Law Degree, Peking University

- Master's in Law and Economics, University of Hamburg

Previous Positions

- Ambassador to the WTO (2021-2025)

- Assistant Commerce Minister (2017-2021)

The 2025 US-China trade war is estimated to cost the global economy $1.3 trillion by 2026.

Household Impacts

- Average US household faces an estimated $2,200 in annual additional costs

- Chinese consumer prices increased 4.2% year-over-year, driven by import substitution

- Global supply chain disruptions add 12-18% to consumer product costs

Market Reactions

- S&P 500 experienced 18% volatility during peak tariff escalation (April 9-12, 2025)

- Chinese yuan depreciated 7.2% against the dollar since February 2025

- Gold prices increased 14% as investors seek safe-haven assets

Sectoral Impacts

- US agricultural exports to China down 68% from pre-tariff levels

- Chinese electronics manufacturers reporting 30-45% drop in US orders

- Textile, furniture and automotive parts industries facing severe disruptions

Source: Data compiled from Tax Foundation, IMF World Economic Outlook, and Peterson Institute for International Economics (April 2025)

Ray Dalio

Founder, Bridgewater Associates

Key Concept: The Beautiful Rebalancing

Dalio envisions a coordinated adjustment where both the US and China reduce their unsustainable economic dependencies in a way that avoids crisis. Rather than an uncontrolled crash, he advocates for a managed transition that addresses the core imbalances that have developed over decades.

Current Situation Assessment

"Americans (and others) buy inexpensive manufactured goods from China that are financed by the United States borrowing from China (and others)... And in the process, the United States has lost its ability to manufacture effectively, which has contributed to the plight of the bottom 60%, while it has developed a geopolitically threatening dependence on manufactured goods from China."

Dalio identifies a circular dependency where US consumption of Chinese goods is financed by Chinese purchases of US debt, creating vulnerabilities for both nations. He characterizes this as "an unsustainable imbalance" that must end either through coordination or crisis.

US Needs to:

- Cut the deficit

- Raise manufacturing

- Cut consumption

- Reduce its debt burden

China Needs to:

- Cut the surplus

- Lower manufacturing

- Raise consumption

- Reduce its debt burden

Key Questions for Resolution

- Will the two sides work well together to engineer big reductions in these imbalances?

- How will a deal be enforced?

- Will this deal be adhered to?

The February-April 2025 period represents the most severe escalation of trade tensions between the world's two largest economies since the 2018-2019 tariff conflicts.

This timeline documents a remarkable 10-week period of rapid tariff escalation, beginning with Trump's initial 10% tariff increase on February 1 and culminating in unprecedented rates by mid-April, with the US reaching 145% and China retaliating with 125% on US goods.

The rhetorical positioning of key leaders has been equally significant. Xi Jinping's declaration on April 11 that "China will never be afraid" represents a stark departure from Beijing's traditionally more measured public statements. Meanwhile, Trump's seemingly contradictory messages—claiming a deal was imminent on April 17 while simultaneously raising tariffs—reflect his characteristic negotiating approach of creating confusion and pressure.

China's strategic appointment of Li Chenggang, a seasoned WTO diplomat, as trade negotiator on April 16 suggests Beijing may be positioning to frame the dispute in multilateral terms rather than accepting a bilateral framework that plays to US leverage advantages.

Global Economic Impact

- Supply chain disruptions are forcing multinational corporations to accelerate "China+1" strategies, primarily benefiting Vietnam, India, and Mexico

- Global inflation pressures are mounting as import costs rise across multiple sectors, potentially forcing central banks to adjust monetary policy

- Financial markets show increasing volatility, with S&P 500 experiencing 18% swings during peak tariff escalation in early April

Diplomatic Ripple Effects

- European Union positioned as potential mediator while simultaneously negotiating its own trade stance with both powers

- ASEAN nations increasingly pressured to choose sides or build strategic hedging policies

- WTO dispute resolution mechanisms overwhelmed, further weakening the global trade architecture

Historical data from the Peterson Institute for International Economics indicates US trade negotiations typically take 1.5 years from initiation to agreement. Given the current trajectory and lack of substantive dialogue by late April, a resolution before Q3 2026 appears increasingly unlikely.

As the trade conflict intensifies, three potential scenarios emerge for the remainder of 2025:

Scenario 1: Negotiated De-escalation (30% probability)

Pressure from domestic business interests and financial markets forces both sides to enter serious negotiations by Q3 2025, gradually reducing tariffs to pre-February levels by year-end, while establishing new monitoring mechanisms for trade practices.

Scenario 2: Sustained High Tariffs (45% probability)

Tariffs remain largely in place through 2025 as both economies adjust to the new normal. Sectors adapt through reshoring, nearshoring, and finding alternative markets, while negotiations continue sporadically with limited progress.

Scenario 3: Further Escalation (25% probability)

The conflict expands beyond tariffs into technology restrictions, financial sanctions, and proxy economic warfare in third markets. Both nations activate "nuclear options" – China selling US Treasury bonds and the US restricting Chinese access to SWIFT or dollar-denominated transactions.

The interplay between economic necessity and political posturing will determine which scenario prevails. With 2025 emerging as a pivotal year in US-China relations, the current tariff war may mark the beginning rather than the climax of a fundamental restructuring of the global economic order.

| Country/Region | U.S. Imports | % of Total | Key Imported Goods | U.S. Exports | % of Total | Key Exported Goods | Trade Deficit/Surplus | World GDP Share |

|---|---|---|---|---|---|---|---|---|

| European Union | 576 | 17.45% | Vehicles, pharmaceuticals | 367 | 21.59% | Aircraft, machinery | -209 | 13.64% |

| China | 427 | 12.94% | Electronics, machinery | 132 | 7.76% | Soybeans, aircraft | -295 | 16.36% |

| Japan | 136 | 4.12% | Vehicles, electronics | 80 | 4.71% | Machinery, aircraft | -56 | 1.64% |

| Vietnam | 114 | 3.45% | Electronics, apparel | 12 | 0.71% | Cotton, machinery | -102 | 0.43% |

| South Korea | 113 | 3.42% | Vehicles, electronics | 71 | 4.18% | Machinery, semiconductors | -42 | 1.64% |

| India | 87 | 2.64% | Pharmaceuticals, textiles | 40 | 2.35% | Precious stones, aircraft | -47 | 3.55% |

| Total (Selected) | 1,672.77 | 50.69% | 825.66 | 48.57% | -847.11 | |||

| Total Trade | 3,300.00 | 100.00% | 1,700.00 | 100.00% |

Key Insights from Trade Data

- China represents the largest U.S. trade deficit at $295 billion, accounting for almost 35% of the combined deficit with selected countries

- While China accounts for 12.94% of U.S. imports, U.S. exports to China represent only 7.76% of total exports, highlighting the trade imbalance at the center of tensions

- The top three trading partners (EU, China, Japan) account for 34.51% of all U.S. imports and 34.06% of exports

- Electronics and machinery appear frequently as both imported and exported goods, suggesting complex supply chain interdependencies

Found this analysis helpful?

Share it with colleagues and friends interested in US-China trade relations